green card holder exit tax

You cease to be a lawful permanent. If the taxpayer has a lot of foreign income for the year and arrives in the second half of the year a dual-status return part-year.

Proof Of Accommodation For The Schengen Visa Dummy Hotel Reservation Is One Of The Most Importan Travel Planner Template Confirmation Letter Itinerary Template

Underpayment of taxes can result in fees ranging from 20-40 of owed taxes depending on the circumstances and severity of the underpayment.

. Another important trigger for taxation upon the termination of. The IRS requires covered expatriates to prepare an exit tax calculation and certify prior years foreign income and accounts compliance. You generally have this status if the US.

This can mean that green card holders who have not formerly surrendered the green card are stuck. This is known as the green card test. You are a lawful permanent resident of the United States at any time if you have been given the privilege according to the immigration laws of residing permanently in the United States as an immigrant.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. A long-term resident is an individual who has held a green card in at least 8 of the prior 15 years. When it comes time to expatriate the expatriate will file a form 8854 in the year following the tax year they expatriate.

The Exit Tax Planning rules in the United States are complex. Long-term residents who relinquish their US. Paying exit tax ensures your taxes are settled when you.

The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. Citizenship and Immigration Services USCIS issued you a. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their US. They remain subject to US Income Tax but cannot. Form 8854 when Giving Up a Green Card.

Green card holders are subjected to the exit tax rules when they abandon their green card status by filing Form I-407 with the US. For example if a person expatriates into 2021 then they will file a form 8854 into 2022 when they file their 2021 tax return. Their expatriate tax return will be a dual-status return.

If you make the election to be a nonresident of the United States for income tax purposes you risk triggering the exit tax. Your risk exists if. Green Card Holders and the Exit Tax.

In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US. For US Green Card holders who have been in the US for 8 years of the last 15 or more anything above about 2 million will likely take some tax planning and structuring work to reduce the exit tax. Lets talk about the exit tax implications of the treaty election by this green card holder to be treated as a nonresident of the United States for income tax purposes.

Tax evasion and conspiracy to defraud. Government or when the US. You are a long-term resident which means you have held a green card in at least 8 of the previous 15 years IRC 877 e 2 877A g 5.

Green Card Holders filing US Tax return for the First time. The exit tax process measures income tax not yet paid and delivers a final tax bill. In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or green card.

Filing a US Tax return for the 1st time can be very challenging as various scenarios need to be considered based on the arrival date of the taxpayer. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Internet Banking Application Form Dutch Bangla Bank Limited Application Form School Admission Form Form

Paper Memory Bouquet Perfect For Her Perfect For Mom Gift Etsy Memory Bouquet First Anniversary First Anniversary Gifts

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

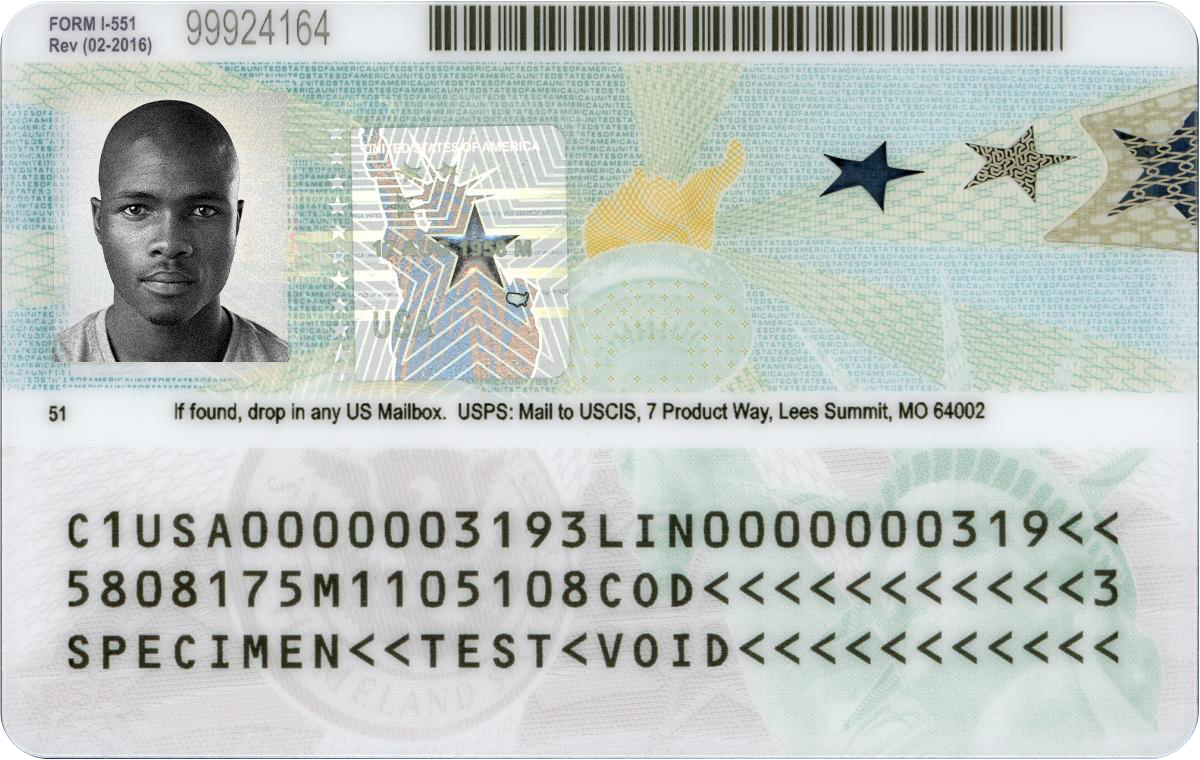

Form I 551 Explained Boundless

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Vat Refund For Tourists In Uae Dubai Mall Tax Refund Dubai

Confetti Cones Paper Doily Cones Wedding Cones Paper Cones Petal Cones Flower Cones Flower Toss Wedding Confetti White Lace Cones

I 551 Temporary Evidence Stamp Guide 2022

Do Green Card Holders Living In The Uk Have To File Us Taxes

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly

How Does Housing Help Build Family Wealth Patrimonio Familiar Ahorro Plan De Ahorro

Exit Tax For Long Term Permanent Residents Blick Rothenberg